Why financing Germany's hydrogen core network could be a blueprint for public investment

Germany’s push towards hydrogen comes at a crucial phase of struggling industry in the country. The government is still trying to agree on how to finance a core aspect of this transition. But once through, it could be a blueprint for fiscal, industrial policy in Germany.

An industry struggling to change

Germany’s Ruhrgebiet region is set to profit massively from its infrastructural position in the country’s push for hydrogen. Sitting in the west of Germany, close to the border with the Netherlands, it is already linked to the port of Rotterdam for LNG and coal shipments. This infrastructure is set to be updated to allow for hydrogen imports through the port of Rotterdam from global suppliers, as Germany seeks to diversify its energy consumption.

The hydrogen and fuel cell center ZBT in Duisburg – a Ruhrgebiet city with an industrial port – is a research and policy institute of the University of Duisburg and has for twenty years poured into hydrogen. They showed me how they coated hydrogen fuel cells with a seal that allows for the chemical process of power generation with these cells.

Fuel cells coated at ZBT in Duisburg. Picture credit: Manuel Vehring

Fuel cells coated at ZBT in Duisburg. Picture credit: Manuel Vehring

The story of the Ruhrgebiet is larger however. Germany’s push for hydrogen rests on many different pillars at once: There is research like at ZBT. They argue for example, that hydrogen may not be the best for cars - battery’s may be better. But for larger vehicles, trains or trucks, hydrogen has advantages.

The difficulty is getting the hydrogen to where it’s used.

In November 2023, the federal government announced its plans to invest in what it calls a »national hydrogen core network«. The proposed plan is, to build new pipelines and update existing tubes to transport hydrogen through the country. This network is supposed to connect at nodes to ports, like Hamburg or the recently and incredibly quickly built German LNG terminals that are said to be upgradable to import hydrogen later.

Proposed Core Hydrogen Network. Picture credit: Google Earth Studio, FNB Gas, Mathis Richtmann

Proposed Core Hydrogen Network. Picture credit: Google Earth Studio, FNB Gas, Mathis Richtmann

Big plans but where is the money?

Germany’s recent strong push for hydrogen came in wake of Russia’s invasion of Ukraine. Recently, the federal government announced plans to invest in power stations run with LNG and possibly later hydrogen to grant energy security during downtime of renewables.

But behind the scenes some in the hydrogen industry now wonder though whether the government’s inertia has lost steam. The November 2023 announcements of plans to invest in the core hydrogen network did get approval from the Bundestag and went live as laws just after Christmas 2023. But a small little detail didn’t pass in this round of lawmaking: The paragraphs that would have clarified how the federal government intended to finance the investment.

Image gallery at Zeche Zollverein Museum, a museum dedicated to the coal mining business of the Ruhrgebiet region. Picture credit: Manuel Vehring

Image gallery at Zeche Zollverein Museum, a museum dedicated to the coal mining business of the Ruhrgebiet region. Picture credit: Manuel Vehring

The government’s plan had been to essentially give credit insurance to the private industry to build this network. The estimated 19.8 bn Euro costs are expected to be covered by the private sector users of the network - similar to the deals used in other pipeline networks in the country as well.

Because maintaining a network of this infrastructure is done as a monopoly market, the government sets a price cap on profits extracted from running this business.

As a financing scheme to build the network, the government had intends to front-load the investment costs and be repaid by the private sector users until 2040.

But crucial financing paragraphs §28r and §28s didn’t make the bill. It has been accepted in an initial hearing on January 18th. The executing company for the network planning – FNB Gas – told me in an email, they still expect to start construction this year but the legislative and regulatory approval process may take until summer1.

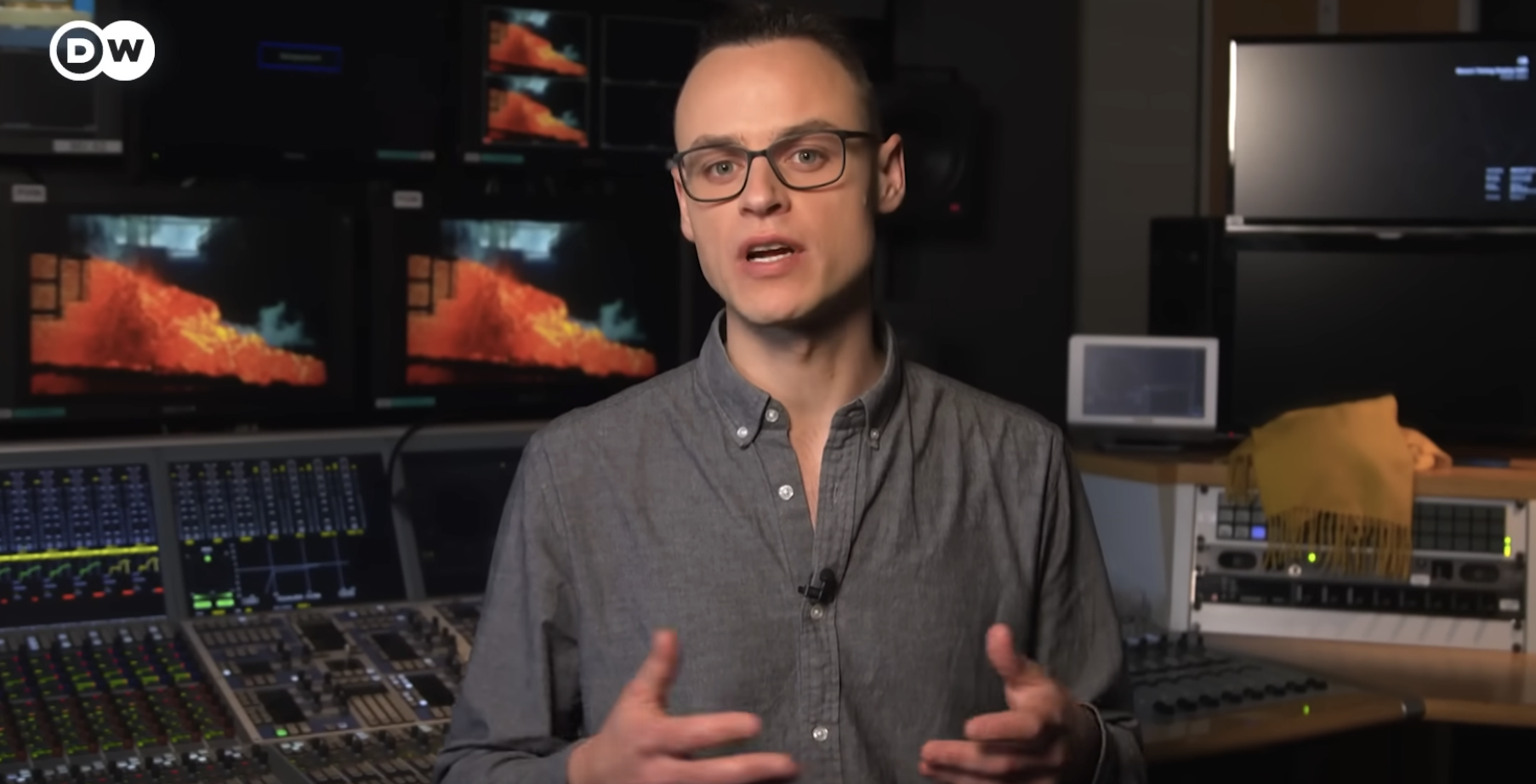

German text of proposed bill on financing the hydrogen network, showing that the federal government insures losses on the investment costs after an initial period until December 31st 2055. Source: Deutscher Bundestag

German text of proposed bill on financing the hydrogen network, showing that the federal government insures losses on the investment costs after an initial period until December 31st 2055. Source: Deutscher Bundestag

The financing mechanism the coalition government proposes is new to the toolkit of fiscal engineering around the country’s financial straightjacket. The constitutional debt break makes it hard for German politics to invest in infrastructure. But with the newly invented »Amortisationskonto«, possible debt is pushed so far into the future, that nobody complains (yet).

The idea is to debt finance the private sector investments until end of 2055. If then gaps in its financing remain, the private sector will carry 24 percent of the losses and the federal government the rest.

As of late 2023, the total cost estimate was the mentioned 19.8 bn Euro. If I’ll just be blunt here: It seems to me, these costs could rise until 2055.

The way I understand the current bill, the government insures this investment against inflation until 2055 - a sensible move in an inflationary environment that needs investments.

What struck me though was what happened when I asked the responsible Ministry for Economics Affairs and Climate Action on what they estimated how large the losses may get: »The financing model and the assumptions on which it is based are being checked for plausibility by an external expert opinion commissioned by the Federal Ministry for Economic Affairs and Climate Protection. The report will be available before the legislative process is completed.«2

The legislative process therefore is making a law without considering the potential losses of its investment because these losses haven’t been determined yet.

Mathis Richtmann; Picture credit: Sophia Harke

Mathis Richtmann; Picture credit: Sophia Harke

Hydrogen is clean but what about jobs?

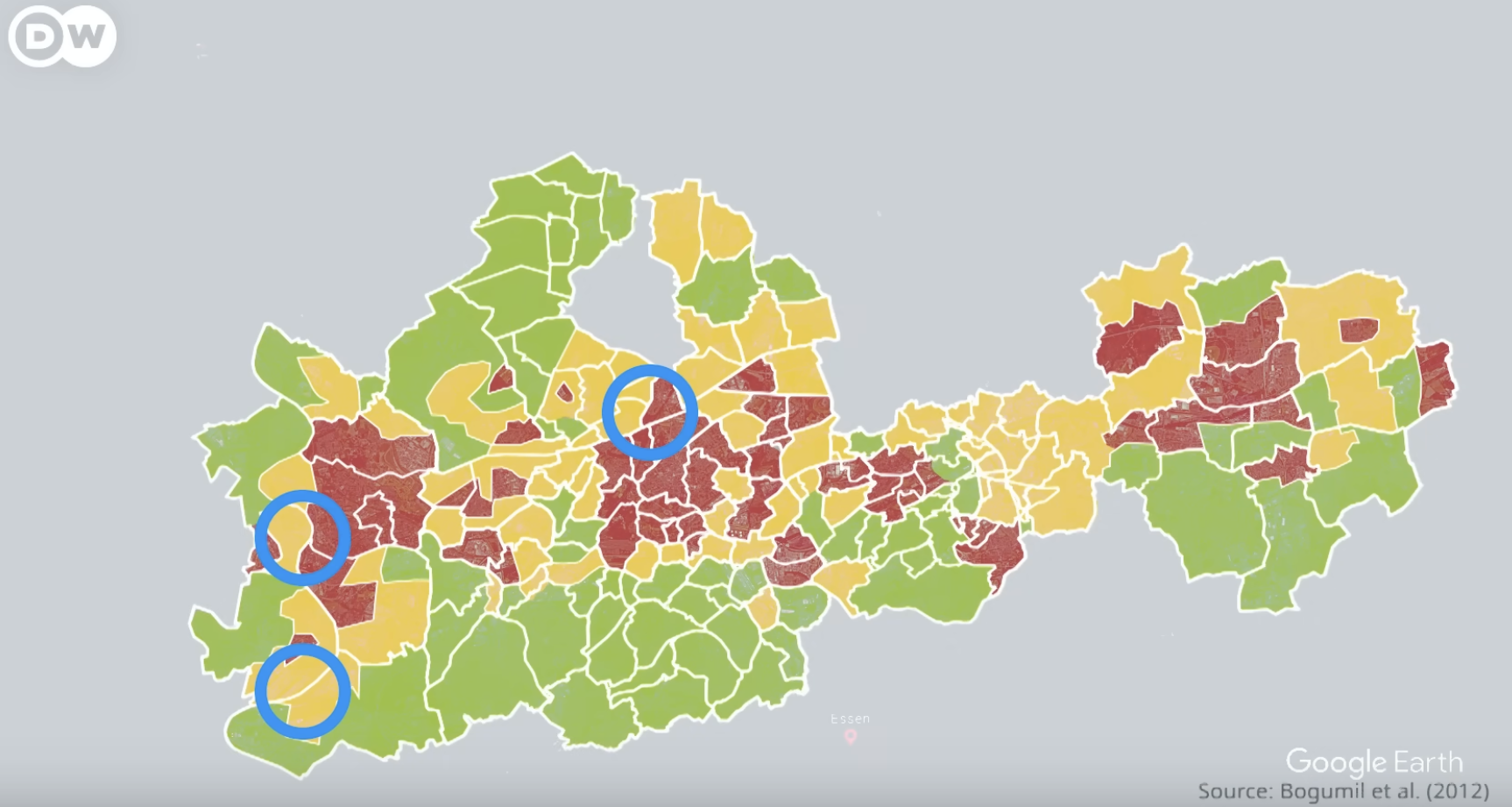

The policy implications of Germany’s hydrogen transition are broader however, than just fiscal policy. The Ruhrgebiet region has been transitioning out of coal production for decades. It used to be the country’s powerhouse: Where coal meets steel. With coal’s decline, the region suffered economically and still has high unemployment levels. But this inequality is regionally disparate. It clusters in a South-North pattern. Southern districts stopped digging for coal earlier.

This 2012 map shows3 regional differences inequality: In areas indicated in red relatively more people receive unemployment benefits.

Picture credit: Bogumil et al. (2012) as cited in Umweltbundesamt (2021), Page 44; DW Graphics

Picture credit: Bogumil et al. (2012) as cited in Umweltbundesamt (2021), Page 44; DW Graphics

On the map, I indicated the three remaining coking plants in the region. The plants make coke from coal that is a crucial steelmaking ingredient. With the steel industry pushing away from using fossil fuels and government subsidies, German steelmakers want to increasingly use hydrogen to supplant coke.

Workers at the remaining coking plants just settled with their employers for less work paid in the coming years.

But there are job potentials in the transition to hydrogen, Vanessa Hünnemeyer of iW Consult told me. She just recently published a ranking of regions in Germany and how well positioned they are to succeed with hydrogen. The Ruhrgebiet comes out top. Hünnemeyer said, the additional jobs would come out of the adjacent manufacturing sectors, the metals and chemicals industries, where re-training to use hydrogen as a new power source could boost job growth.

But private sector investors are getting uneasy. With the delayed financing for the core network and the downsizing of crucial climate financing through the Climate and Transition Fund, the government has much explaining to do on how rigorously it is set to push for hydrogen.

Kokerei Schwelgern where workers will see hours and pay reduced. Picture Credit: Google Earth Studio, Mathis Richtmann

Kokerei Schwelgern where workers will see hours and pay reduced. Picture Credit: Google Earth Studio, Mathis Richtmann

One way of indicating such intent would be to publicly acknowledge how high it intends to insure the hydrogen core network investment. I am looking forward to what the »external expert opinion« commissioned by the government will calculate as a worst-case scenario for investment costs in excess of the current 19.8 bn Euro.

How the proposed financing mechanism avoids political gridlock

The proposed financing mechanism would push potential losses into 2056. Last year, the government’s past policy on navigating around the debt break faltered: It had pushed infrastructure financing into shadow balance sheets like the challenged Climate and Transition Fund. This new approach called »Amortisationskonto« / »amortisation account«4 tries to flip the financing on its head:

The off-balance-sheet model of shadow funds had relied on the notion of putting an imaginary sum of money into a government fund, issuing that as debt and using the proceeds to pay for things. The Amortisationskonto changes that in a revival of the Public-Private-Partnership. Rather than putting up a sum, the government insures potential losses of the private sector. Since any forecast in the year of 2024 for how high these losses may be at the end of 2055 may include a small margin of error, the mechanism cleverly pushes the financing question so far into the future, that it avoids political gridlock in the current fragile coalition government.

Footnotes

-

»der nächste Schritt auf dem Weg zur Realisierung des Kernnetzes ist die Abgabe des formellen Antrags durch die FNB. Dies kann erst nach Inkrafttreten der noch im parlamentarischen Verfahren befindlichen Finanzierungsregelungen erfolgen. Danach konsultiert die BNetzA noch einmal und genehmigt (nach einer Prüfung) dann das Kernnetz. Die FNB rechnen damit noch vor der Sommerpause. […]« ~ via email, January 8th 2024 ↩

-

»Das Finanzierungsmodell und die ihm zugrundeliegenden Annahmen werden durch ein externes Gutachten plausibilisiert, welches das Bundesministerium für Wirtschaft und Klimaschutz in Auftrag gegeben hat. Das Gutachten wird vor Abschluss des Gesetzgebungsverfahrens vorliegen.« ~ Spokesperson Bundesministerium für Wirtschaft und Klimaschutz (BMWK) via email, January 8th 2024 ↩

-

Bogumil et al. (2012) as cited in Umweltbundesamt (2021), Page 44: https://www.umweltbundesamt.de/publikationen/analyse-des-historischen-strukturwandels-im-0 ↩

-

The initial draft idea was published by dena - Deutsche Energieagentur, a company owned by the federal government in August 2022. ↩