Paper -- From bazooka to backstop - the political economy of standing swap facilities

Lea Steininger and I published in Cambridge Journal of Economics. The paper explores decision making of central bankers.

Bureaucratic familiarity

Managing money isn’t an easy job. When money is tight, central bankers usually step in. So in a crisis, they check out what they have at their disposal to increase liquidity, that is money in the system. They ask: What’s worked before? They tinker with a gauge, they try new things. At some point though, they’ll say: “Well that’s a nice fix we’ve got here, should we keep it or ditch it?”

This paper explores how central bankers decide in such a situation. It draws on archival research on meeting minutes of central bankers of the US Federal Reserve and interviews with policy makers and market participants at the time.

It concludes that central bankers basically prefer what we call “bureaucratic familiarity”. They like to know that both market participants and they themselves know a backup is in place.

You can read the full paper here: Full paper

Abstract-

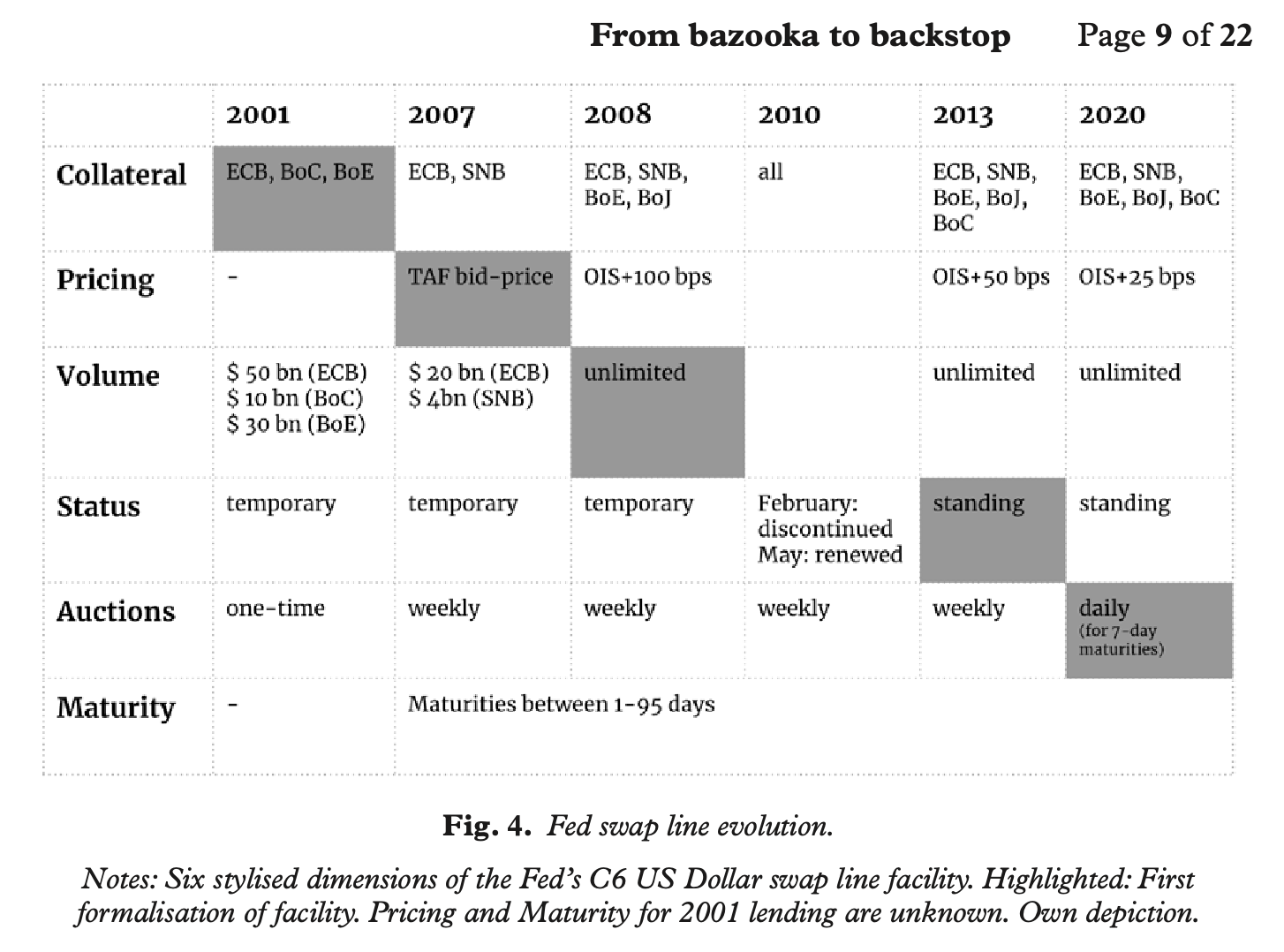

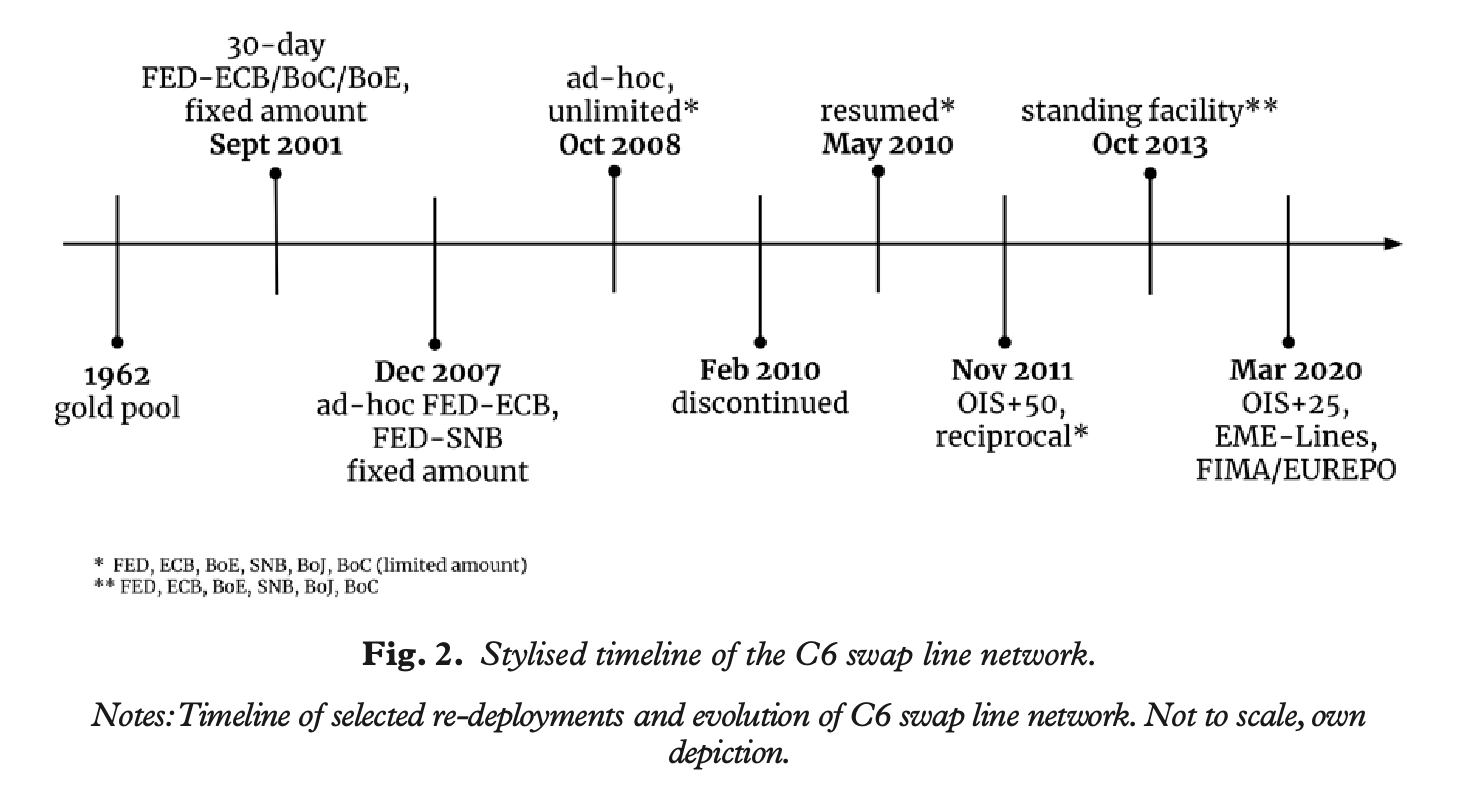

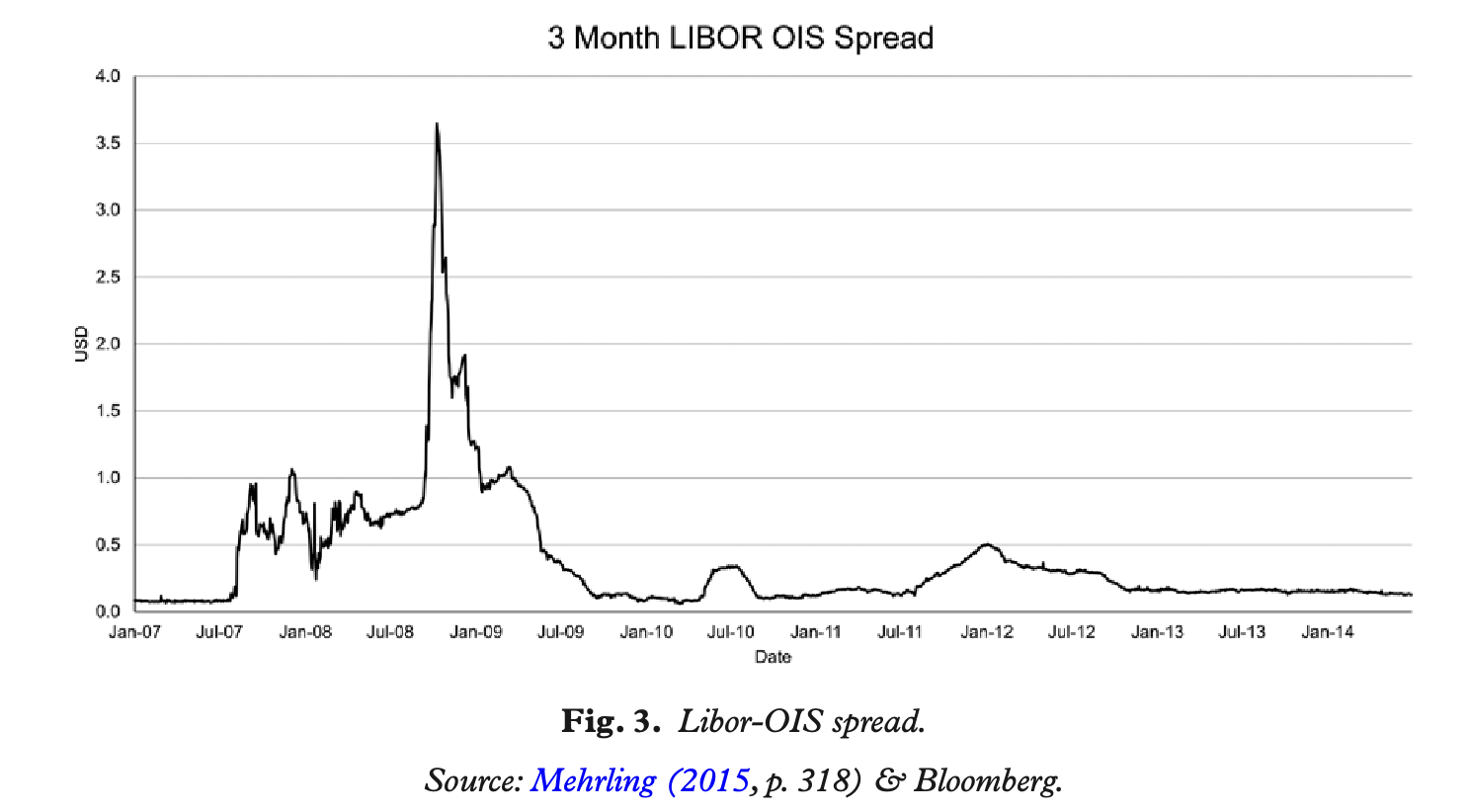

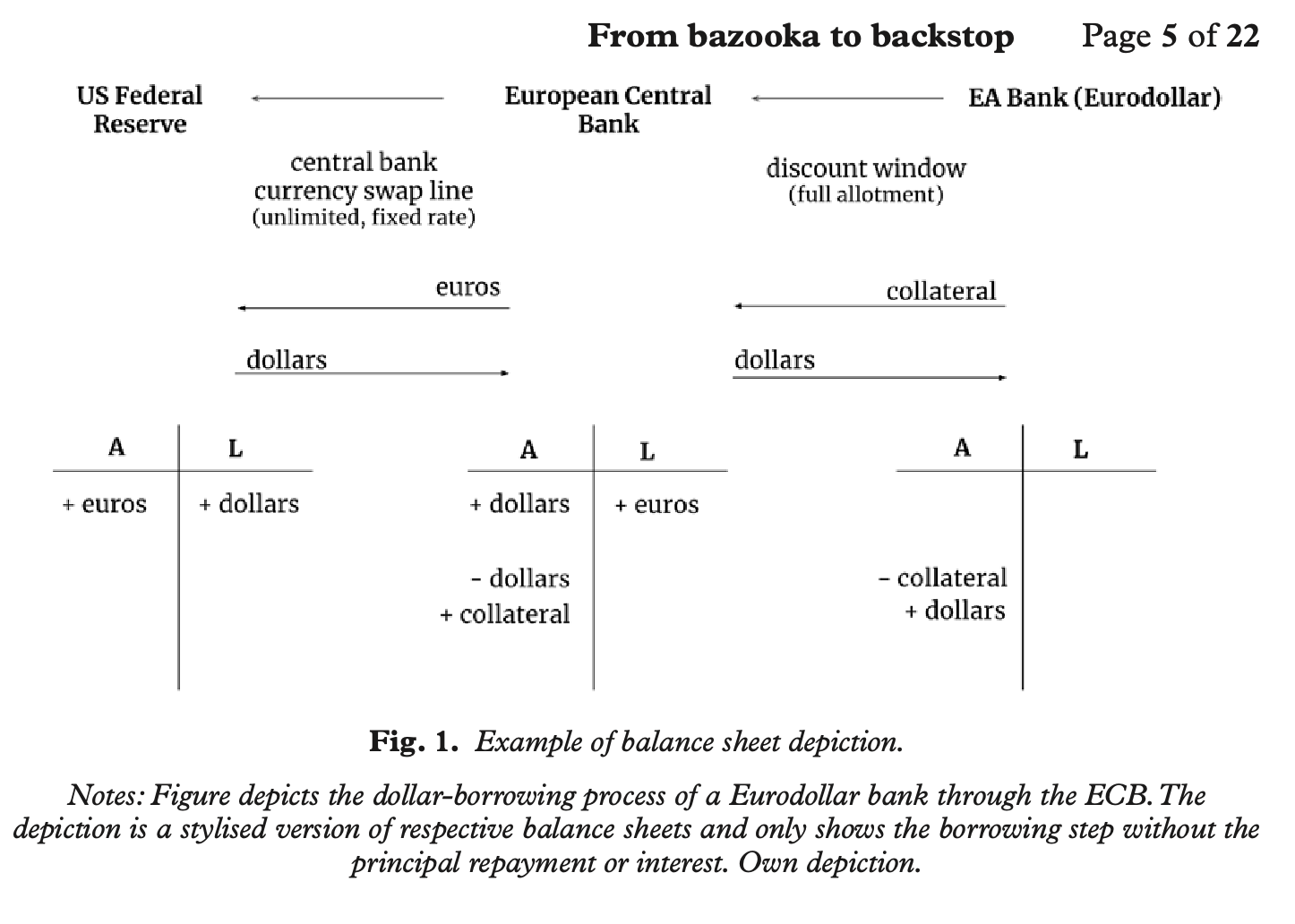

The permanent international lender of last resort consists of a swap line network between six major central banks (C6), centring around the US Federal Reserve. Arguably, this network is a solution to a long-debated problem as it provides public emergency liquidity provision to the world’s largest financial market, the Eurodollar market. Drawing on exclusive interviews with monetary technocrats as well as a textual analysis of Federal Open Market Committee meeting transcripts over the course of 14 years, we reconstruct how this facility came into being. Building on Kalyanpur and Newman (2017) and Braun (2015), we develop an interpretive framework of bricolage to contextualise its formation: in times of crisis, central bankers rely on retrospection, experimentation and creative re-deployment to develop their tools. In non-crisis times, however, the tools that prevail are those that offer what we call ‘bureaucratic familiarity’: the C6 swap line network became a permanent feature of international finance because technocrats had got used to it.

Paper presented at

- ‘EAEPE’ Conference – Critical Macro Finance Track, Bilbao (online), 2-4 September 2020

- ‘Intersections of Finance and Society’, City University London, 12-13 December 2019

- ‘THE EURO AT 20 – MACROECONOMIC CHALLENGES’, FMM Conference, Berlin, 24-26 October 2019

- ‘Widerspruch’, Momentum Kongress, Hallstatt, 10-13 October 2019